- Assessing Potential Returns and Risks:

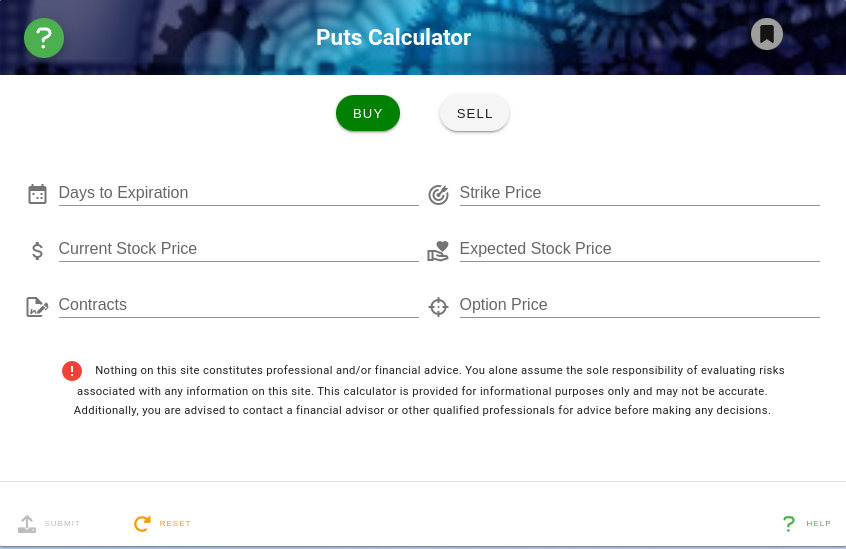

A puts calculator helps traders evaluate their potential returns and risks associated with a put option. By inputting various parameters such as the strike price, expiration date, and current market price of the underlying asset, traders can gain insights into how their investment might perform under different scenarios

- Maximizing Profit:

These calculators often allow users to enter their expectations for the stock's future price movement. Based on this information, the calculator can suggest the best put option that maximizes profit at the expected price point

- Estimating Profit or Loss:

A puts calculator can estimate the potential profit or loss from an options trade. By providing details about the type of option and market conditions, traders can make informed decisions about whether to enter or exit a position

- Understanding Market Dynamics:

Since the value of a put option increases as the price of the underlying asset decreases, a puts calculator can help traders understand how changes in market conditions might affect their options. This understanding is crucial for both hedging against losses and speculating on downward price movements

Maximize your investment strategy with our advanced Puts Options calculator. Gain a deep understanding of the Put option process as you effortlessly assess profits, risks, and break-even points. Seamlessly navigate Put options trading and make confident investment decisions. Elevate your financial strategy with our powerful tool.