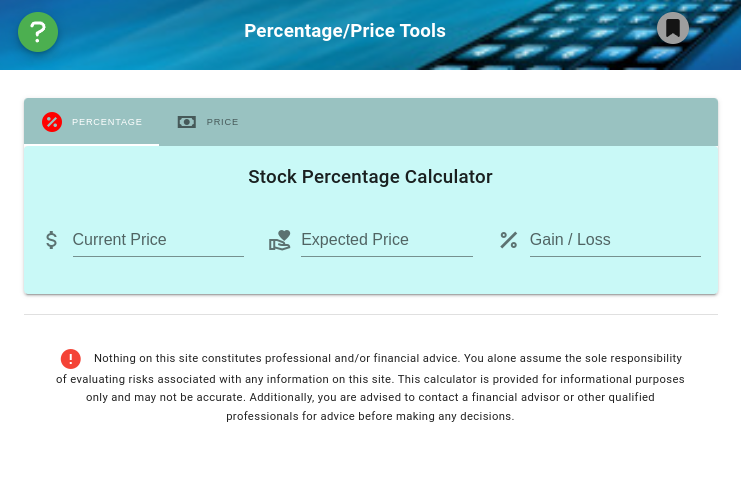

When you need to calculate possible stock prices by either percentage or by gain/loss this tool may assist you in stock investment decision-making.

- Assessing Potential Profits and Losses:

Stock option calculators help users estimate the potential profit or loss from an options trade under various scenarios. For example, they allow users to input variables such as the current stock price, strike price, and expiration date to visualize how changes in stock price affect the value of the option.

- Evaluating Theoretical Option Prices:

These calculators often incorporate pricing models like the Black-Scholes formula to determine the theoretical price of an option. By adjusting variables such as volatility, time to expiration, and interest rates, users can see how these factors influence the option's value

- Planning for Tax Implications:

For employees or investors exercising stock options, calculators can estimate the tax liabilities associated with their decisions. Taxes depend on factors like the type of option (e.g., incentive stock options vs. non-qualified stock options) and the timing of exercising and selling the shares

- Visualizing Breakeven Points:

Stock option calculators can determine the breakeven price for an option, which is the stock price at which the trader neither makes a profit nor incurs a loss

- Scenario Analysis for Strategic Planning:

These tools allow users to simulate different scenarios, such as changes in stock price or company growth rates, to estimate how the value of their options might change over time. This is particularly useful for employees in startups or early-stage companies who want to understand the potential future value of their equity

- Supporting Multi-Option Strategies:

Advanced calculators can model complex strategies involving multiple options, such as spreads or straddles. This helps traders visualize the combined impact of multiple positions on their portfolio